What is Buoying Crude Oil at $73?

Crude Oil (October)

Yesterday’s close: Settled at 73.17, down 0.49

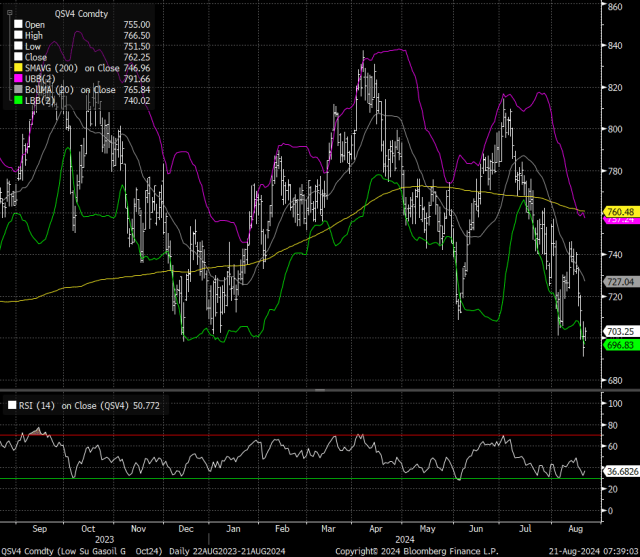

Crude futures were muted overnight, drifting lower until catching a slight bid in front of major three-star support at 72.20-72.59, which aligns with the settlement lows from August 2-6. The trade continues to digest the same macro catalysts as the previous couple of sessions; Gaza peace, Chinese demand, and Powell's Friday speech remain uncertain. EIA stocks will be released at 9:30 CST with estimates pointing towards a -2,200k barrel draw, +400k build of Distillates, and -100k draw of Gasoline. European Gasoil futures are the strongest on the board right now, with the Oct contract rallying +1.26% through the European session. Gasoil longs with a stop below $691 (yesterday's low) have caught our trader's eye at these levels.

Price action continues to respond to the aforementioned 72.20-72.59 level, but yesterday’s pop was contained by major three-star resistance at 74.52-74.83, aligning the newly created .382 retracement with Friday’s settlement. As price action again works off overnight weakness, our Pivot and point of balance will be crucial on the session, where continued price action above will help soke higher prices; this level comes in at......

Want to Keep Reading our Energy Update?

Subscribe to our daily Energy Update for daily insights into Crude Oil and more! Technicals, including our proprietary trading levels, and actionable market bias.

Sign Up for Free Futures Market Research – Blue Line Futures

On the date of publication, Bill Baruch did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.