Earnings Preview: What to Expect From Atmos Energy’s Report

Valued at $24.6 billion by market cap, Atmos Energy Corporation (ATO) is one of the largest fully regulated natural gas-only utilities in the U.S., serving over 3.3 million customers across eight states through its distribution and pipeline & storage segments. The Dallas, Texas-based company operates more than 79,000 miles of distribution pipelines and over 5,700 miles of transmission pipelines, along with several underground storage facilities.

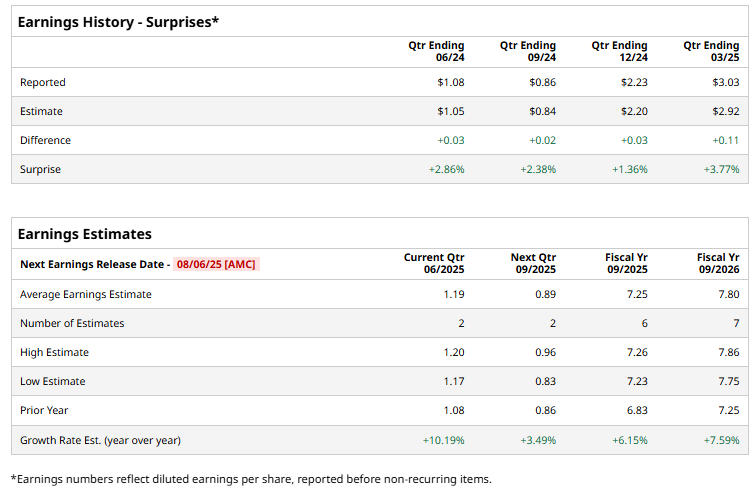

ATO is set to deliver its third-quarter results after the markets close on Wednesday, Aug. 6. Ahead of the event, analysts expect the utility giant to report an adjusted EPS of $1.19, up 10.2% from $1.08 reported in the year-ago quarter. Moreover, the company has surpassed the Street’s bottom-line expectations in each of the past four quarters, which is admirab.

For the current year, ATO is expected to report an adjusted EPS of $7.25, marking a 6.2% increase from $6.83 reported in fiscal 2024.

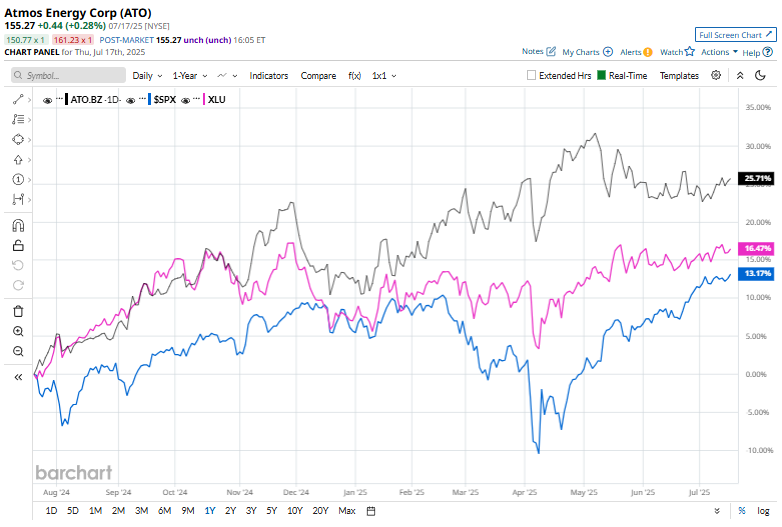

ATO shares have soared 24.6% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 12.7% returns and the Utility Select Sector SPDR Fund’s (XLU) 17.5% gains during the same time frame.

On May 7, ATO shares rose marginally after reporting its Q2 results. Its revenue rose 18.4% year-over-year to $1.95 billion and net income stood at $486 million, driving EPS up to $3.03. Additionally, both its Distribution and Pipeline & Storage segments saw solid growth, while capital expenditures totaled $839.7 million for the quarter, focused primarily on safety and system reliability.

Atmos also raised its full-year EPS guidance to $7.20–$7.30 and increased its dividend by 8.1%, reflecting continued operational momentum and regulatory success.

The consensus view on ATO stock remains moderately optimistic, with a “Moderate Buy” rating overall. Of the 14 analysts covering the stock, opinions include six “Strong Buys,” one “Moderate Buy,” and seven “Holds.” ATO’s mean price target of $160.82 indicates a 3.6% upswing from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.