Netflix Produces Strong Q2 FCF, But NFLX Stock Dips - Is It a Buy Here?

/Netflix%20on%20laptop%20by%20Jade87%20via%20Pixabay.jpg)

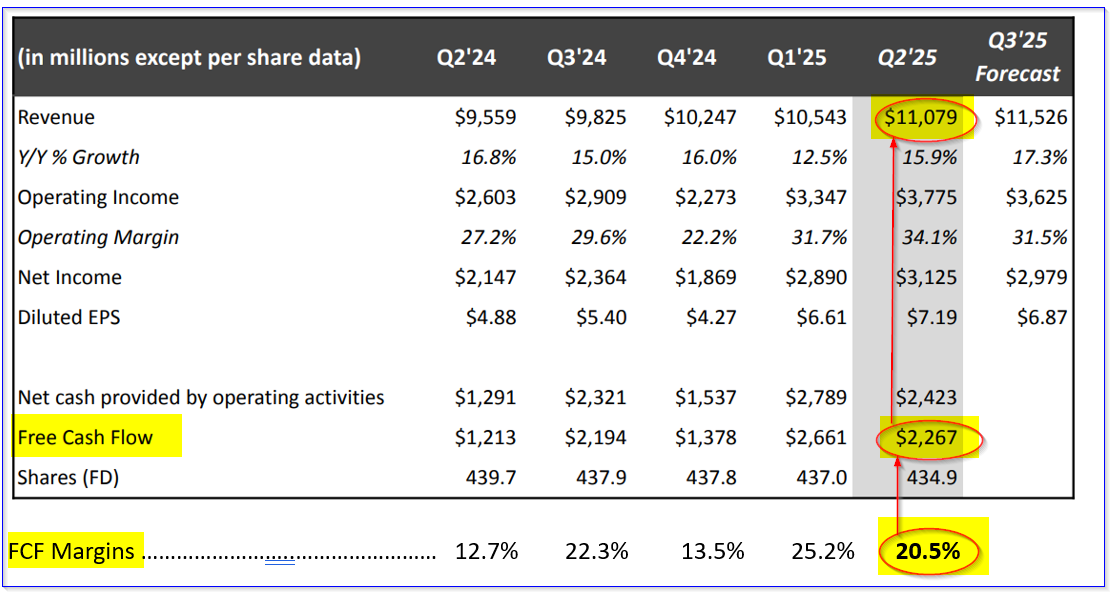

Netflix, Inc. (NFLX) reported yesterday that its Q2 revenue grew +15.9% and its FCF grew 14.2% Y/Y, but dipped on a Q/Q basis. NFLX stock could be a bargain, given its 20.4% FCF margin, and using a 1.65% FCF yield. Shorting out-of-the-money (OTM) put options works as well.

NFLX is at $1,212.77 in midday trading, down over 4.8% today, but it could be a buying opportunity. This article will show why.

Last quarter, after the company released its results, I projected in an April 20 Barchart article that NFLX stock could be worth $1,176 per share. Today, I am raising that target price by +14% to $1,383 per share using a similar method as before.

Strong FCF Margins

The table below, taken from Netflix's Q2 shareholder letter, shows that although revenue rose 15.9% Q/Q, Netflix's operating cash flow and free cash flow (FCF) dipped in Q2. Moreover, the quarterly FCF margin (i.e., FCF / revenue) fell from 25.2% to 20.4%.

Don't focus on that. Over the past 12 months, its FCF margins have stayed very strong. Stockanalysis.com shows the trailing 12-month (TTM) FCF margins on its cash flow analysis tab. For example, last quarter the TTM FCF margin was 18.54%, so it has risen almost 200 basis points this quarter to 20.5%.

As a result, we can use that to forecast Netflix's margins going forward. After all, management raised its revenue forecast and indicated its operating margins would stay stable.

Forecasting FCF

Analysts now project 2025 revenue of $44.84 billion and 2026 revenue of $50.37 billion. That means the next 12-month (NTM) revenue forecast is $47.6 billion (up from $46.96 billion in my prior Barchart article estimate).

So, if we assume that Netflix will continue to make a 20.4% FCF margin over the next year:

$47.6b x 0.204 = $9.71 billion FCF NTM estimate

We can use this to value NFLX stock over the next 12 months. How?

Price Targets for NFLX Stock

One way is to use its TTM FCF yield. That metric assumes that 100% of its FCF will be paid out to shareholders and the stock will have a “yield.”

StockAnalysis.com shows that Netflix generated $8.5 billion in FCF over the trailing 12 months (this can also be computed from the Netflix quarterly FCF figures above).

Since NFLX's market capitalization today is $515.356 billion, according to Yahoo! Finance, its TTM FCF yield is:

$8.5b / $515.356 b = 0.0165 = 1.65%

That is the same as a multiple of 60.6x (i.e., the reciprocal of 1.65%). Therefore, we can multiply our NTM FCF forecast by 60.5:

$9.71b x 60.5 = $587.46 billion NTM market cap

That result is +14% higher than today's $515.4 billion market cap. As a result, our price target is 14% higher than today's price:

$1,212.77 x 1.14 = $1,382.56 p/sh price target

So, assuming Netflix maintains a 20.4% FCF margin over the next year, NFLX stock could potentially be worth 14% more or $1,383 per share. This assumes the market values its FCF at over 60x, or a 1.65% FCF yield.

There is no guarantee this will occur. For example, the multiple could fall (i.e., the FCF yield might rise). As a result, it makes sense to set a lower buy-in price. One way to do this, and get paid, is to sell short out-of-the-money (OTM) put options in nearby expiry periods.

Shorting OTM Puts

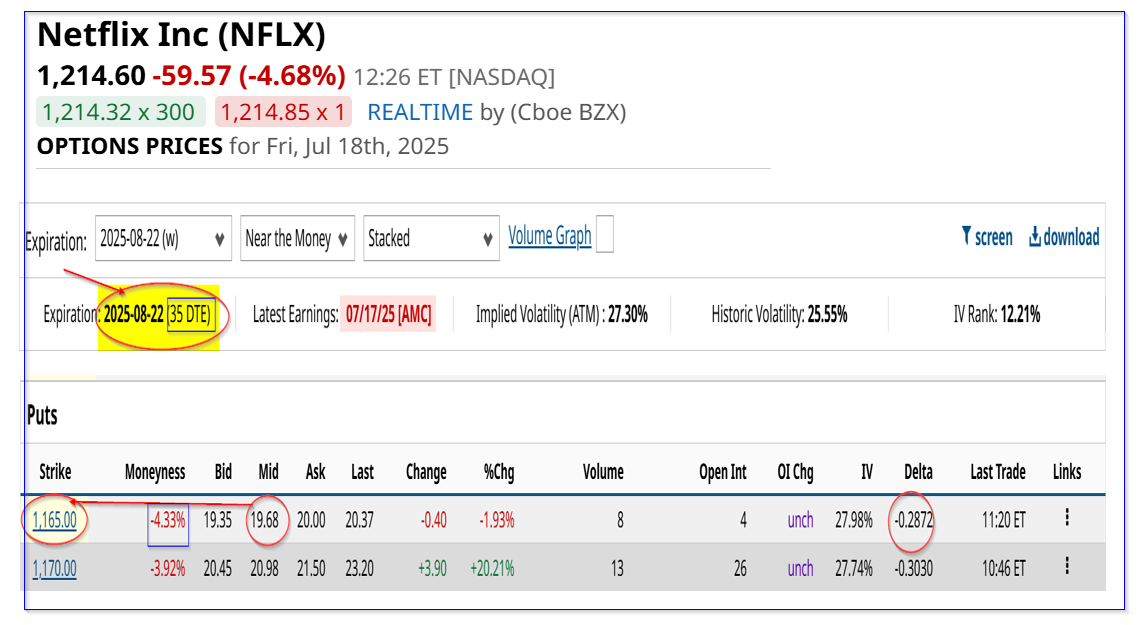

For example, look at the Aug. 22 expiry period, just over one month from now. It shows that the $1,165.00 put option strike price, which is over 4% lower than today's trading price, has an attractive premium worth shorting.

The $1,165.00 put has a midpoint price of $19.68, which allows an investor who enters an order to “Sell to Open” this put contract to make an immediate yield of 1.69% (i.e., $19.68/$1,165 = 0.0189).

This also means that the potential breakeven buy-in price is $1,165.00 - $19.68, or $1,145.32 (i.e., if NFLX falls to $1,165.00 on or before Aug. 22). That is still over 5.5% lower than today's price.

So, it provides good downside protection and a potential lower buy-in price.

Moreover, investors willing to take on more risk can sell short the $1,170 strike price put. The account would receive $20.98 (i.e., $2,098 per put contract) on a secured collateral of $117,000 (i.e., $1,170 x 100 shares per put contract).

That provides an immediate yield of 1.793% (i.e., $20.98/$1,170), and the investor has a breakeven price (if NFLX falls to $1,170) of $1,149.02, or -5.4% below today's price.

Moreover, an investor in this strike price stands to potentially make an upside of +20%, if NFLX hits our target price:

$1382.56/$1149.02 = 1.203 -1 = +20.3% upside

In addition, even if NFLX stock doesn't fall to this breakeven price, an investor has an expected return (ER)of over 5% over 3 months. This can be done by using a mix of these two short put trades (i.e., (1.69% +1.793%)/2 = 1.7415%) over 3 months:

1.7415% x 3 = 5.22% 3 mo ER

The bottom line is that investors in NFLX puts using this method can set a lower buy-in price and potentially make a good expected return. However, investors in puts should be careful to understand all the risks associated with this type of trade. One way to do this is to study Barchart's Learn Center tabs on options trading.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.