Amazon Falls on Fears That AWS Is Losing Market Share: Should You Buy the AMZN Stock Dip Here?

/Amazon%20box%20delivery%20by%20Tumisu%20via%20Pixabay.jpg)

Amazon (AMZN) released its Q2 earnings after the close last night on Thursday, July 31, and the stock is trading lower today as the company’s guidance came in lighter than consensus estimates. Moreover, fears of its enterprise-focused Amazon Web Services (AWS) losing market share spooked investors.

While it has been a strong earnings season for the “Magnificent 7,” as names like Microsoft (MSFT) and Meta Platforms (META) zoomed higher after showing progress on artificial intelligence (AI) monetization, Amazon will join Tesla (TSLA) as only the second constituent to gap down after the June quarter earnings. (Apple (AAPL), while lower today, is off just 1.83%.) In this article, we’ll look at some of the key takeaways from Amazon’s Q2 earnings and examine whether it makes sense to buy the dip here.

Amazon Q2 Earnings Analysis

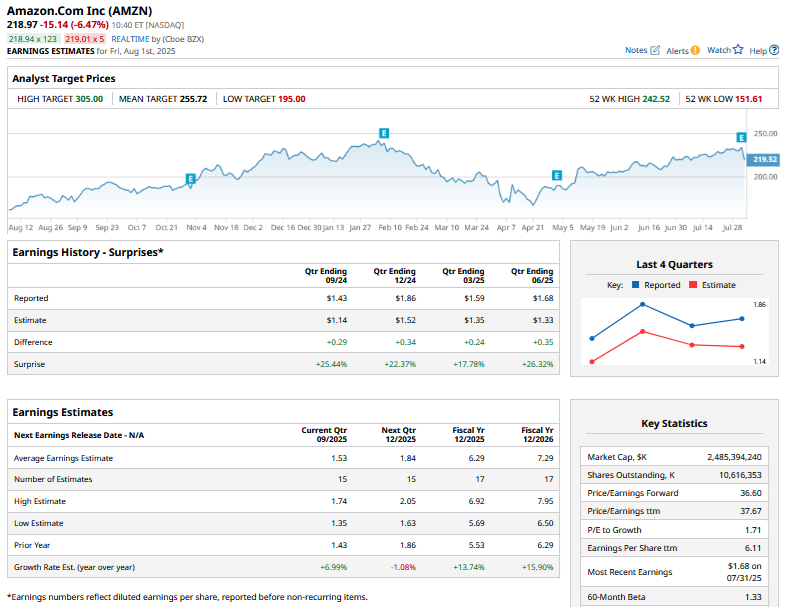

Amazon reported revenues of $167.7 billion in the quarter that easily surpassed the $162.09 billion that analysts were expecting. The company’s earnings per share came in at $1.68, ahead of the $1.33 that analysts were modeling.

The company guided for Q3 revenues between $174 billion and $179.5 billion, implying a YoY growth between 10%-13%, which was better than Street estimates. However, management guided for Q3 operating income between $15.5 billion and $20.5 billion, with the midpoint of that range trailing the consensus estimate of $19.48 billion. Weaker-than-expected guidance has been a recurring theme for Amazon over the last few quarters, as the company has blamed macroeconomic conditions, and more recently, “tariff and trade policies” along with “recessionary fears” as factors affecting its guidance.

Key Takeaways from Amazon’s Q2 Earnings

The key reason Amazon stock is falling today seems to be due to the relatively tepid performance of AWS. Here are some of the key takeaways from that segment’s performance.

- AWS Margins Dipped in Q2: During Q2, AWS revenues rose 17.5% YoY, and it now has an annualized revenue run rate of $123 billion. However, that segment’s operating margin fell to 32.9% as compared to a record high of 39.5% in Q1. The company attributed lower margins to higher stock-based compensation, higher depreciation expense, and adverse forex movements.

- AWS Might Be Losing Market Share: Expectedly, Amazon faced questions over AWS losing market share in cloud, as Microsoft (MSFT) Azure and Google (GOOG) (GOOGL) Cloud – the top two cloud players in that order, after Amazon – reported 39% and 32% yearly revenue growth, respectively, in the June quarter. Notably, during its fiscal Q4 2025 earnings release, Microsoft said that Azure’s annual revenue was $75 billion in the quarter, marking the first time that the Satya Nadella-led company provided a dollar number for that business.

- Azure is Now 65% the Size of AWS: Alluding to Microsoft, CEO Andy Jassy said that while Azure is around 65% the size of AWS, Amazon has a “pretty significant" leadership position in the cloud market. Responding to a question about AWS, Jassy said, “We're growing faster than others and sometimes others are growing faster than us.” Jassy added, “The security and the privacy of that data matter a lot, and there are very different results in security in AWS than you’ll see in other players.”

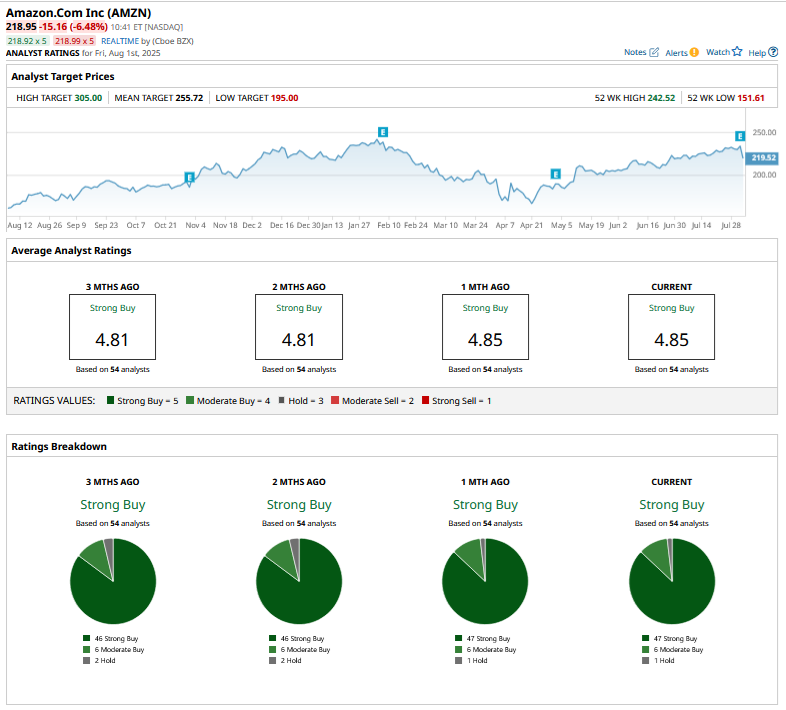

AMZN Stock Forecast After Q2 Earnings

Analysts don’t seem too perturbed by Amazon’s guidance, though, and several brokerages - including Rosenblatt, Bank of America, Piper Sandler, Barclays, and Susquehanna - all raised the stock’s target price following the earnings report, while maintaining their respective ratings. To be fair, the target price adjustments haven’t been to the scale that we have seen in the past, as Amazon’s latest earnings have raised a question mark about AWS’s market domination in the cloud market.

Scott Devitt, Managing Director of Equity Research at Wedbush Securities, gave a B+ to Amazon’s earnings. While he is not too apprehensive about the Q3 guide, given the fact that Amazon tends to provide a conservative forecast that it happens to beat more often than not, he believes the plunge today is related to AWS’s relatively weak performance vis-à-vis other big cloud players.

Should You Buy Amazon Stock On the Dip?

I have been a bit bearish on Amazon for the last month or so, given the tariff uncertainty. The company managed to dodge the tariff bullet in Q2 as President Trump scaled back his rhetoric. Sellers on its platform had also built up inventory in advance to absorb the tariff costs.

However, as that inventory now withers away and tariff uncertainty comes back to haunt markets, we could see some volatility in names like Amazon. From a valuation perspective, Amazon currently trades at a forward price-to-earnings (P/E) multiple of 36.6x, which, while not overly demanding, is not mouthwateringly cheap either, especially for the short term.

Overall, I am not rushing to buy the Amazon stock dip here, even though I continue to remain invested in the company for the long term.

On the date of publication, Mohit Oberoi had a position in: AMZN , GOOG , MSFT , META . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.