Is Wall Street Bullish or Bearish on Gen Digital Stock?

/Gen%20Digital%20Inc%20logo%20on%20building-by%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

With a market cap of $17.7 billion, Gen Digital Inc. (GEN) is a global leader in cyber-safety solutions dedicated to empowering digital freedom for individuals, families, and small businesses. Through its trusted portfolio of brands, including Norton, Avast, LifeLock, Avira, AVG, and CCleaner, the company delivers comprehensive cybersecurity, identity protection, and online privacy services.

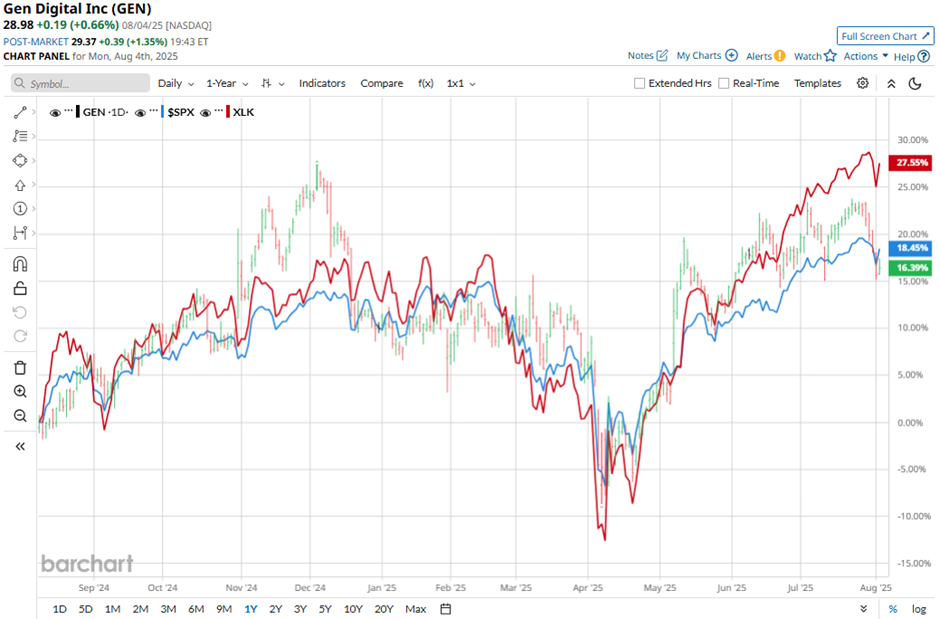

Shares of the Tempe, Arizona-based company have underperformed the broader market over the past 52 weeks. GEN stock has increased 15.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.4%. In addition, shares of Gen Digital have risen 5.8% on a YTD basis, compared to SPX's 7.6% rise.

Looking closer, GEN stock has also lagged behind the Technology Select Sector SPDR Fund's (XLK) 28.1% return over the past 52 weeks.

Shares of Gen Digital surged 8.2% following its strong Q4 2025 results on May 6, with adjusted EPS of $0.59 exceeding estimates and rising 11.3% year-over-year. Revenue grew 5% to over $1 billion, driven by heightened demand for AI-powered cyber safety solutions amid rising digital threats. The company reported an increase in its direct customer base to 40.4 million and improved its customer retention rate to 78%.

For the fiscal year ending in March 2026, analysts expect GEN's EPS to grow 13.4% year-over-year to $2.28. The company's earnings surprise history is mixed. It beat or met the consensus estimates in two of the last four quarters while missing on two other occasions.

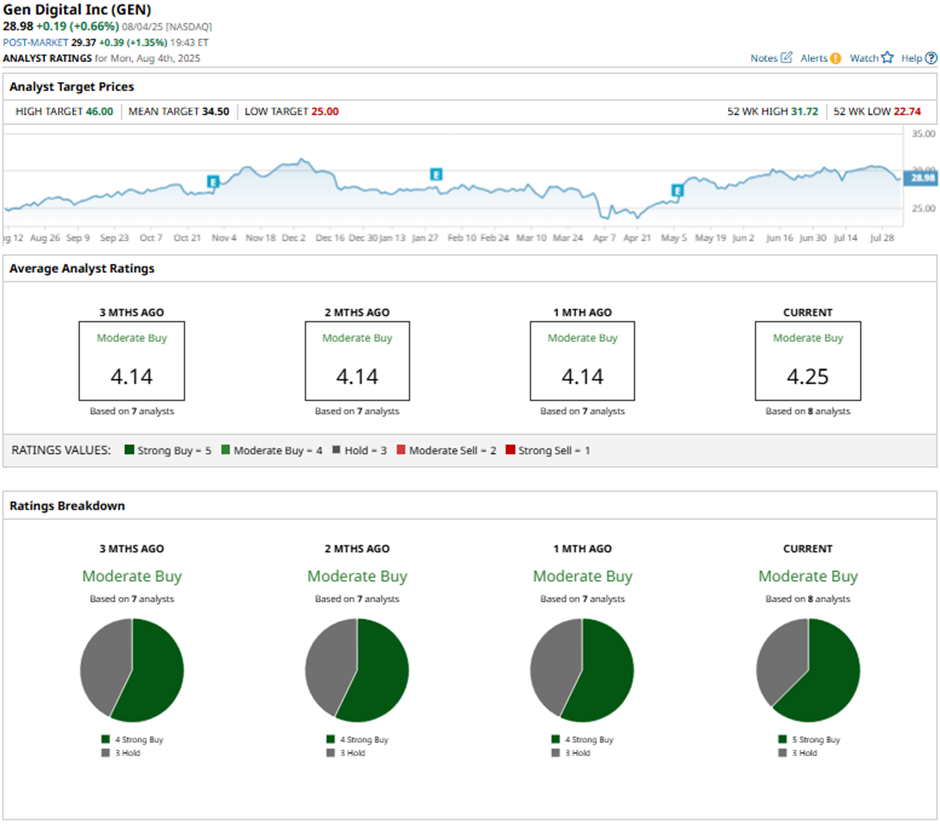

Among the eight analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buys” and three “Hold” ratings.

On Jul. 14, Barclays raised Gen Digital’s price target to $32 while maintaining an “Equal Weight” rating.

As of writing, the stock is trading below the mean price target of $34.50. The Street-high price target of $46 implies a potential upside of 58.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.