Dear Disney Stock Fans, Mark Your Calendar for August 21

Disney (DIS) is set to launch the long-awaited direct-to-consumer (DTC) service for ESPN on Thursday, Aug. 21. Sports are a key pillar of Disney’s growth strategy, and the launch will be a key event that investors should watch closely. In this article, we’ll look at Disney’s outlook as it takes yet another step in its pivot toward streaming.

ESPN has priced its DTC service, which CEO Bob Iger termed a “sports fan’s dream,” at $29.99 per month. The company is also offering ESPN as a bundle with Disney+ and Hulu at a promotional price of $29.99 per month for the first 12 months – a price Iger said is an “incredible, incredible bargain for the consumer.”

The company has touted features such as increased personalization, integration of statistics, and a personalized sports center for the app. It will also include access to betting, fantasy sports, and commerce solutions, which will help the company add to its revenues.

Disney Has a Diverse Portfolio of Media and Entertainment Assets

Disney is a media and entertainment conglomerate with a diverse portfolio. It has the legacy linear TV business, which is in a structural, if not terminal, decline. Disney also has a movie production business, which holds some of the most popular intellectual property. The company has a streaming business, which has turned profitable. Then we have the Experiences segment that houses the theme parks and cruises, and is the proverbial cash cow for the company.

Sports Are a Key Pillar of Disney’s Strategy

Sports have been a key growth area for Disney, and the company has taken several steps to make its offering even more attractive for users. These include:

- Partnering with Penn Entertainment (PENN) to launch the sports-gambling platform ESPN Bet. Sports betting is gaining traction and could be a key growth driver for ESPN in the coming years.

- Signing a deal with WWE for exclusive domestic rights to major WWE events starting in 2026. As part of the $1.6 billion agreement, Disney will stream all Premium Live Events (PLEs), including WrestleMania.

- Partnering with the NFL, giving the football league a 10% stake in ESPN. In return, ESPN will own and operate the NFL Network. It will also acquire some other media assets owned by the NFL, including the NFL’s linear RedZone Channel and NFL Fantasy.

- ESPN has also launched a streaming bundle with FOX One priced at $39.99 per month.

Why ESPN DTC Launch Is a Key Event for Disney

The launch of ESPN’s DTC service is a key event for Disney. While the company will need to pay a dividend to the NFL for its 10% stake in ESPN, Disney is confident that the launch will be accretive to its earnings in the first year after the close of the transaction. The company expects the NFL partnership to add to its revenues and operating profits and also lead to lower churn among its subscribers.

Disney will be launching ESPN DTC ahead of key live sports events, including college football and NFL seasons. Live sports is a fast-growing market for broadcasters, and that’s where the real value for ESPN DTC will lie. No wonder streaming companies like Alphabet’s (GOOG) YouTube and Netflix (NFLX) are betting big on live sports.

Disney Stock Forecast

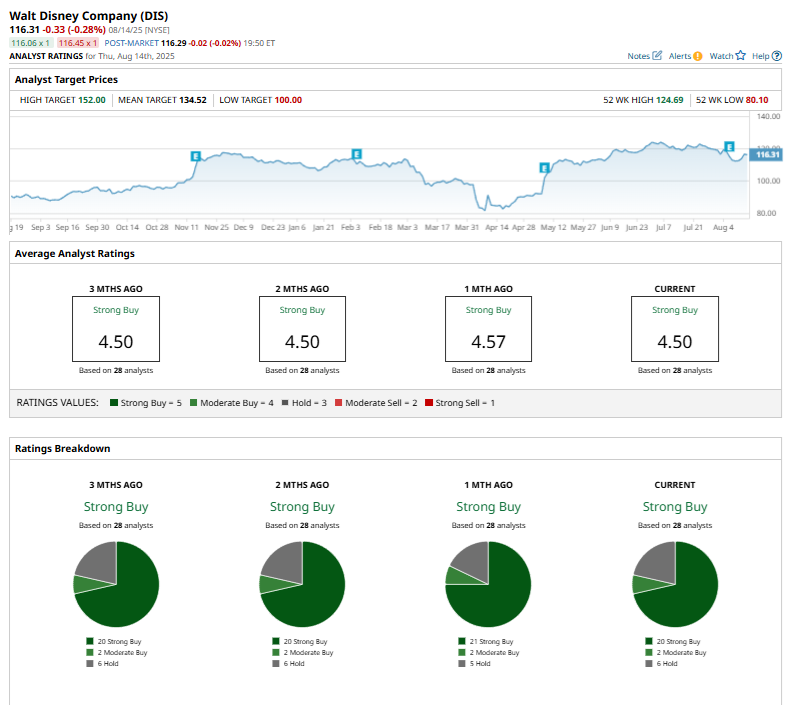

Disney has a consensus rating of “Strong Buy” from the 28 analysts covering the stock, while its mean target price of $134.52 is 15.6% higher than the Aug. 14 closing price.

I have been bullish on Disney stock for quite some time amid the transformation under Iger, in which the company’s streaming business has turned profitable. For context, that business lost almost $1.5 billion in fiscal Q4 2022, which was the last full quarter under Iger’s predecessor Bob Chapek.

I remain bullish on Disney as the company progresses in its turnaround. The stock’s valuations are also reasonable at a forward price-earnings (P/E) multiple of 19.83x. While the levels are not mouthwateringly cheap, I find them decent enough to add some more shares to my existing holdings.

On the date of publication, Mohit Oberoi had a position in: DIS , NFLX , GOOG , PENN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.