Can Microsoft Stock Hit $680 in 2025?

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

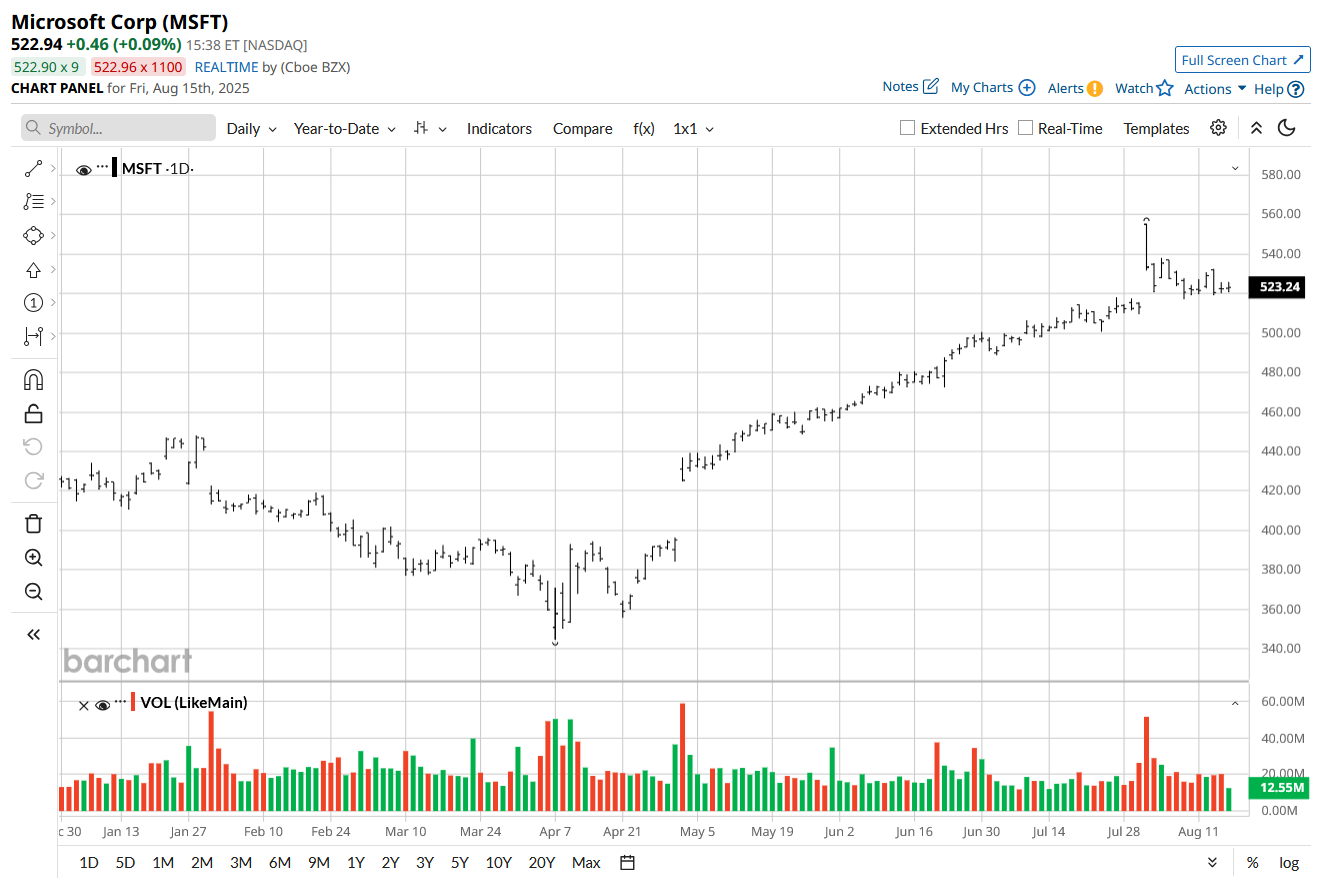

In the wake of its blockbuster fiscal 2025 performance driven by surging Azure and artificial intelligence (AI)-related growth, Microsoft (MSFT) has sparked optimism among analysts about further upside potential. While the stock recently climbed to its 52-week high of $555.45 on July 31, some bullish forecasts are even targeting the elusive $680 mark, which is the current Street high and a level that would represent a 30% upside from current prices.

But alongside this enthusiasm, tempered by cautious macroeconomic headwinds, is $680 a realistic milestone for Microsoft or a stretch too far?

About Microsoft Stock

Microsoft, headquartered in Redmond, Washington, is a global technology leader known for its expansive portfolio that spans software, cloud computing, AI, gaming, and enterprise solutions. Microsoft has evolved from a dominant operating system provider into a powerhouse across multiple tech verticals.

In recent years, Microsoft has aggressively expanded its presence in AI, including a deep partnership with OpenAI, integrating advanced AI capabilities across its product suite. The company boasts a market cap of approximately $3.9 trillion, reflecting its heavyweight status and making it one of the most valuable public companies in the world.

MSFT’s share price has demonstrated solid resilience and upward momentum throughout 2025, closing the last session at $522.48. On a year‑to‑date (YTD) basis, the stock has delivered a gain of 24%, significantly outperforming broader market indexes like the tech-heavy Nasdaq Composite’s ($NASX) 12% returns.

Driving this momentum is Microsoft’s commanding position in cloud and AI, robust financial performance, a strategic expansion through AI infrastructure, and a growing dominance in enterprise AI offerings, which have fueled investor confidence and lifted its market valuation.

Microsoft has consistently commanded a premium price tag and is currently trading at 34.95 times forward earnings, higher than many of its industry peers and its historical average.

Solid Financial Performance

On July 30, Microsoft published its financial results for the fourth quarter ended June 30 and the full fiscal year. The company closed FY2025 with a strong performance across all segments, anchored by impressive momentum in cloud and AI.

In Q4 FY2025, the company achieved $76.4 billion in revenue, marking an 18% year‑over‑year (YoY) increase, alongside net income of $27.2 billion, a 24% rise and EPS of $3.65, also up 24%, all significantly surpassing analysts’ expectations.

The Intelligent Cloud segment delivered standout performance, with revenue hitting $29.9 billion, marking a 26% increase, driven by Azure and other cloud services growth. Microsoft Cloud overall soared to $46.7 billion, up 27%, while Productivity & Business Processes climbed 16% YoY to $33.1 billion, and More Personal Computing rose 9% to $13.5 billion.

For the full fiscal year, Microsoft posted $281.7 billion in revenue, a 15% increase over the prior year, and net income of $101.8 billion, up 16%. Operating income rose 17% from the prior year to $128.5 billion, reflecting strong across-the-board growth and a refined cost structure. Its EPS rose 16% YoY to $13.64.

Guidance provided painted a confident outlook for the year ahead. The company confirmed that capital expenditures would surpass $30 billion in Q1 as Microsoft scales its AI infrastructure, while maintaining expectations for double-digit growth in both revenue and operating income in FY2026.

Analysts remain optimistic as they predict EPS to be around $15.32 for fiscal 2026, up 12.3% YoY, before surging by another 16.8% annually to $17.89 in fiscal 2027.

What Do Analysts Expect for Microsoft Stock?

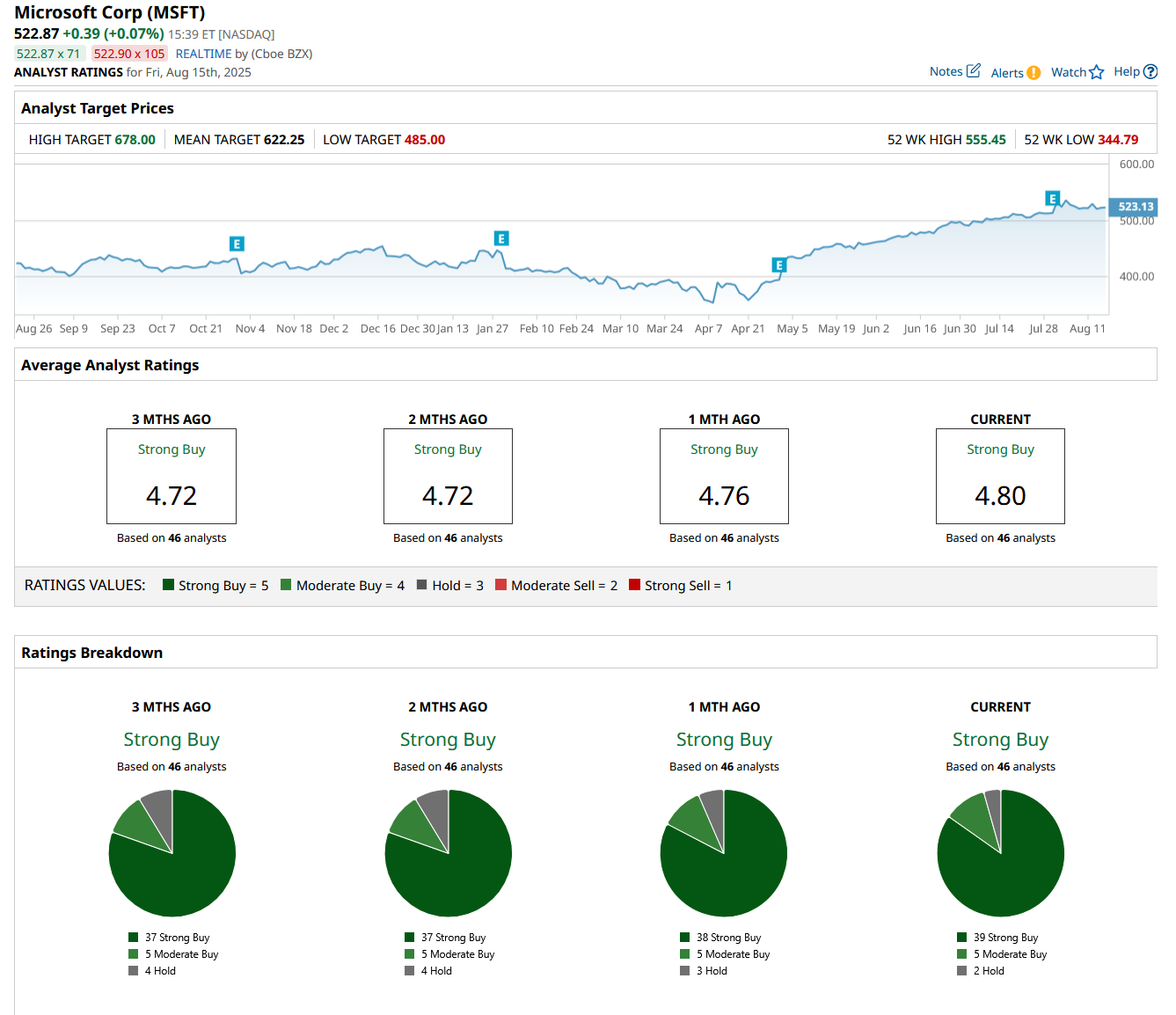

Following Microsoft’s robust Q4 FY2025 earnings release, analysts have grown increasingly bullish on the stock, with Citi leading the charge by raising its target to a Street-high of $680, up from a previous level, while maintaining a “Buy” rating. Citi cited Microsoft’s standout Q4 performance, particularly Azure’s accelerating growth and the company’s leadership in AI monetization, as key drivers of its more optimistic outlook.

Also, Jefferies raised its price target on Microsoft to $675 from $600, maintaining a “Buy” rating and naming it a top pick after a strong fiscal Q4, highlighting Azure’s impressive 39% growth and robust forward-looking indicators.

UBS also joined the optimism, as it raised its price target on Microsoft to $650 from $600, maintaining a “Buy” rating after strong quarterly results, including 39% Azure growth, impressive backlog and bookings, and solid margins, suggesting potential AI-driven momentum behind Azure’s accelerating performance.

Overall, MSFT has a consensus “Strong Buy” rating. Of the 46 analysts covering the stock, 39 advise a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining two analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for MSFT is $622.25, indicating a potential upside of 19%. Meanwhile, Citi’s Street-high target price of $680 suggests that the stock could rally as much as 30%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.