Constellation Energy Stock: Is CEG Outperforming the Utilities Sector?

Valued at a market cap of $96.6 billion, Constellation Energy Corporation (CEG) produces and sells energy products and services. The Baltimore, Maryland-based company operates through five geographic segments: Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions.

Companies valued at $10 billion or more are generally described as “large-cap stocks”, and Constellation Energy fits this description perfectly. The company ranks among the nation’s largest providers of reliable, emissions-free energy and stands out as a leading supplier with a diverse generation mix spanning nuclear, solar, wind, and hydroelectric power.

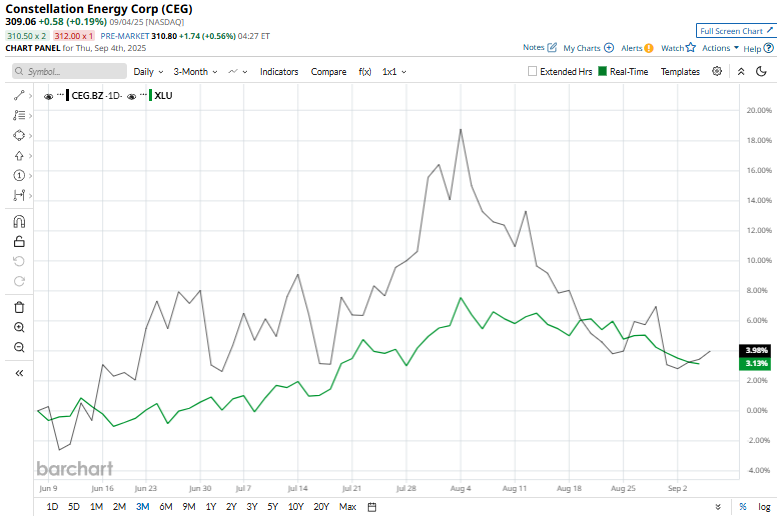

But, Constellation Energy’s stock has dropped 13.4% from its 52-week high of $357. Shares of CEG have gained 3.2% over the past three months, slightly trailing the Utilities Select Sector SPDR Fund's (XLU) 3.4% return over the same time frame.

However, CEG stock has soared 38.2% year-to-date, whereas XLU has surged 10.6%. In addition, shares of Constellation Energy have climbed 74.1% over the past 52 weeks, significantly outpacing the XLU’s 9% rise over the same time frame.

While the stock has traded above its 200-day moving average since early May, it has dipped below its 50-day moving average since the end of August.

CEG’s robust momentum over the past year is driven by strong demand for clean power, major partnerships like a 20-year supply deal with Meta Platforms, Inc. (META), and its $26.6 billion acquisition of Calpine to expand into natural gas and geothermal.

On Aug. 7, CEG shares dipped marginally after the company reported its Q2 results. Its adjusted EPS came in at $1.91, up 13.7% year over year. The company’s revenue improved 11.4% year over year to $6.1 billion.

Additionally, top rival Ormat Technologies, Inc. (ORA), has lagged behind CEG stock. ORA stock has gained 35.4% on a YTD basis and 25.7% over the past 52 weeks.

Among the 16 analysts covering the stock, the consensus rating is “Moderate Buy,” and the mean price target of $371.14 indicates an upswing potential of 20.1% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.