Booking Holdings’ Quarterly Earnings Preview: What You Need to Know

/Booking%20Holdings%20Inc%20app%20and%20website%20by-AlexandraPopova%20via%20Shutterstock.jpg)

Headquartered in Norwalk, Connecticut, Booking Holdings Inc. (BKNG) has grown into one of the world’s largest online travel service providers. With a market cap of $166.3 billion, the company manages a portfolio of prominent brands, including Booking.com, Priceline, Agoda, and Kayak, that collectively serve travelers in over 220 countries and territories.

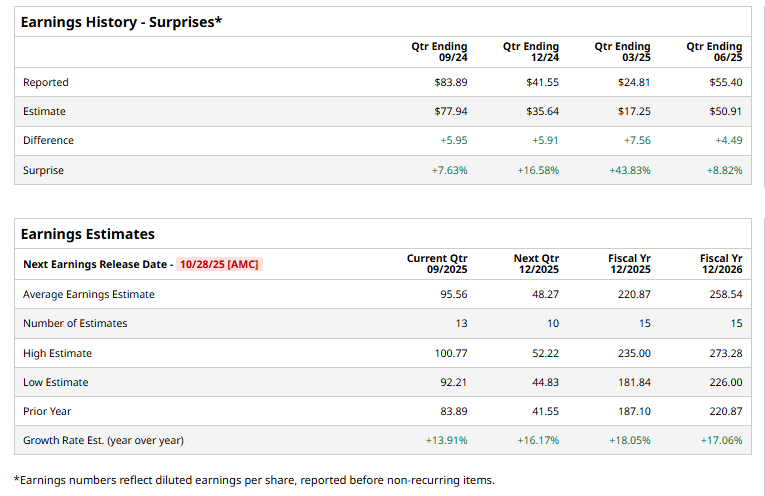

The booking company is set to report its third-quarter earnings after market close on Tuesday, Oct. 28. Ahead of the event, analysts expect BKNG to report a profit of $95.56 per share, up 13.9% from $83.89 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect Booking Holdings to report an EPS of $220.87, up 18.1% from $187.10 in fiscal 2024.

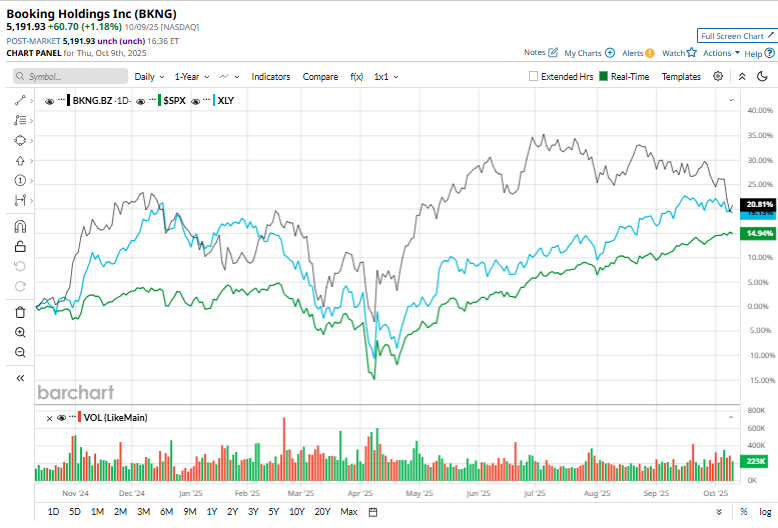

Booking Holdings' shares have gained 21% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 16.3% gains and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 18.6% returns over the same period.

Over the past year, Booking Holdings has outperformed the broader market, fueled a rebound in international travel, and experienced robust demand from high-income travellers. Ongoing technology investments and its diverse portfolio of leading travel brands have also contributed to sustained growth and reinforced its position as a market leader.

On Oct. 9, BKNG shares climbed 1.2% after BTIG analyst Jake Fuller reiterated a “Buy” rating on Booking Holdings, setting a $6,250 price target.

The consensus opinion on BKNG stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 38 analysts covering the stock, 22 advise a “Strong Buy” rating, two suggest a “Moderate Buy” rating, and 14 suggest a “Hold.”

The average target price for BKNG is $6,081.41, indicating a potential upside of 17.1% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.