Caterpillar’s Quarterly Earnings Preview: What You Need to Know

/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Caterpillar Inc. (CAT) is a leading global industrial firm specializing in construction and mining equipment, diesel and natural-gas engines, industrial gas turbines, and related services, headquartered in Irving, Texas. Caterpillar’s scale and market presence are reflected in a market cap of around $234.4 billion. This industrial giant is expected to announce its fiscal third-quarter 2025 earnings soon.

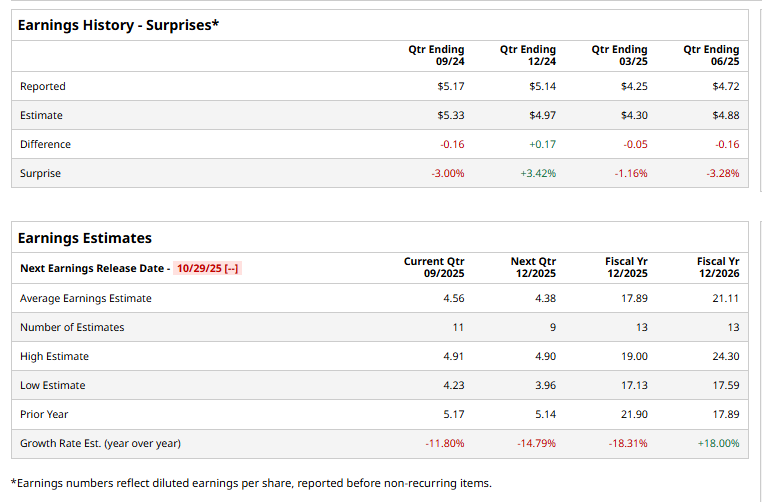

Ahead of this event, analysts expect the company to report a profit of $4.56 per share, down 11.8% from $5.17 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in three of the past four quarters, while surpassing on one occasion.

For fiscal 2025, analysts expect CAT to report an EPS of $17.89, down 18.3% year-over-year from a profit per share of $21.90 in fiscal 2024. However, in FY2026, the company’s EPS is expected to rebound, increasing 18% annually to $21.11.

CAT stock has grown 26.3% over the past 52 weeks, outperforming the Industrial Select Sector SPDR Fund’s (XLI) 12.1% surge and the S&P 500 Index’s ($SPX) 16.3% uptick during the same time frame.

Caterpillar’s stock has gained momentum amid strong demand signals, especially from energy and data-center infrastructure projects. The company is increasingly seen as benefiting from the artificial intelligence (AI) and data center boom; its power generation and energy segments are expected to see tailwinds. Also, lower interest rates make financing big equipment purchases more affordable, which tends to boost demand for heavy machinery, improving investor sentiments.

On Oct. 8, CAT shares rose 4% after multiple firms raised their price targets, citing strong profit margins, a $35 billion backlog, and steady demand supported by favorable economic trends.

Wall Street analysts are moderately bullish about CAT’s stock, with a “Moderate Buy” rating overall. Among 22 analysts covering the stock, 12 recommend “Strong Buy,” nine suggest a “Hold,” and one advice a “Moderate Sell” rating. While CAT currently trades above its mean price target of $465.53, the Street-high target of $582 indicates a potential upswing of 16.3% from the current market price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.